- For the 2021-22 and 2022-23 school years, allows a school employer to hire a retiree if there is an emergency or shortage of day-to-day substitute teachers.

- Allows individuals holding day-to-day substitute permits to serve as a substitute in any certificate area for up to 20 days substituting for the same teacher. If the service exceeds 20 days, a long-term substitute permit is required. An individual may serve as a day-to-day substitute for more than one educator as long as each assignment does not last more than 20 days.

- Allows individuals holding a valid and active Pennsylvania certificate or comparable out-of-state certificate to serve as a day-to-day substitute in the individual’s certificate area for up to 20 days. If the service exceeds 20 days or if a certified individual is substituting outside of their certificate area, an emergency permit is required.

- Expands the substitute teacher program for prospective teachers for the 2021-22 and 2022-23 school years by removing the 10-day limit to substitute for the same teacher and 20-day limit to serve as a substitute for multiple teachers.

- Extends the time limit for an individual with an inactive certification to be employed as a substitute from 90 days to 180 days.

- Allows individuals who have completed a teacher preparation program and are in the process of scheduling the required testing to be issued a temporary substitute certificate. For the 2021-22 and 2022-23 school years, the certificate may be used for assignments of more than 20 consecutive days.

- Creates a new permit for a classroom monitor to deliver assignments that are pre-planned by a teacher. The monitor may not plan lessons, create or grade student work. The monitor must meet certain education requirements and/or be currently employed as a paraprofessional.

Category: News

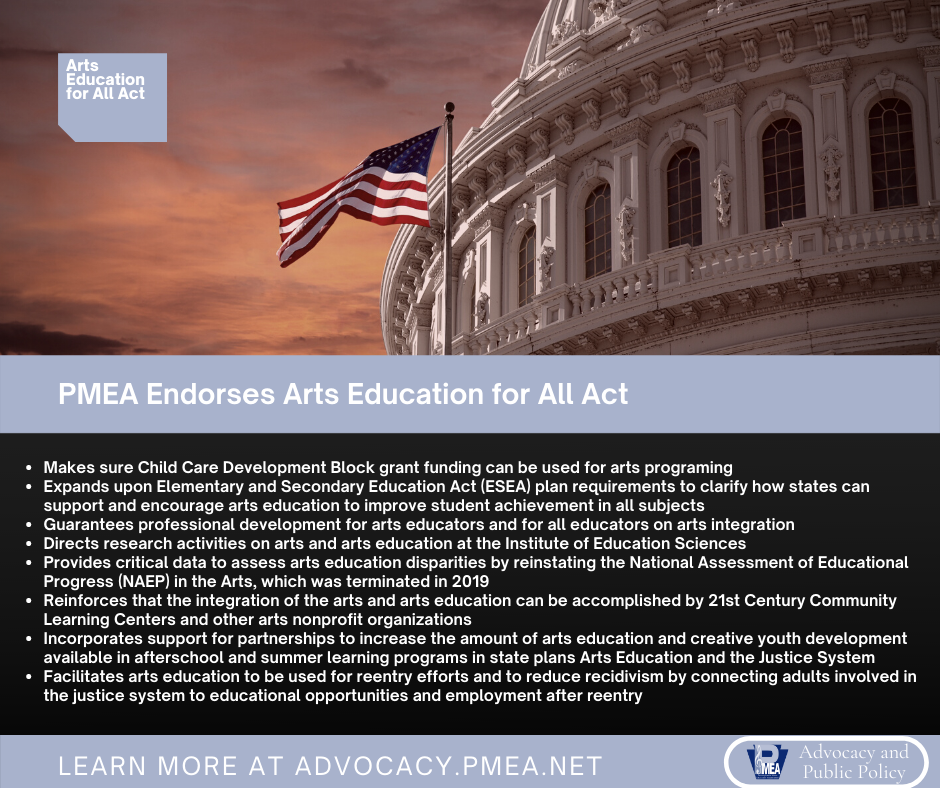

PMEA Endorses Arts Education for All Act

WASHINGTON, DC [10/15/21] – Congresswomen Suzanne Bonamici (D-OR), Chellie Pingree (D-ME), and Teresa Leger Fernández (D-NM) introduced comprehensive legislation to increase access to arts education.

The Arts Education for All Act will support and encourage arts education and programming for our young children, K-12 students, and youth and adults involved in the justice system. It will help to close existing gaps in access to arts education, which has the potential to improve the lifelong health and success of both children and adults.

“The arts are a fundamental part of a well-rounded education, especially now when innovative thinking and creative problem solving are in high demand,” said Congresswoman Suzanne Bonamici, Chair of the Education and Labor Subcommittee on Civil Rights and Human Services and Co-Chair of the STEAM Caucus. “Providing all students with the opportunity to receive a quality arts education is a matter of equity. Arts education should be available to all students, not just those who have artistic families or the financial resources to pay for an arts education on their own. I envision a better future where everyone can enrich their lives through the arts, and the Arts Education for All Act will help make that a reality.”

“Arts education improves the lives of children, nurtures their creativity, and helps maintain their well-being. Yet the arts are often the first programs to be cut in schools. While I’m grateful for existing federal support for arts education, we should be making programs more accessible and encouraging students and educators to get more involved,” said Congresswoman Chellie Pingree, co-chair of the bipartisan Congressional Arts Caucus and Chair of the House Appropriations Subcommittee on Interior and the Environment, which oversees funding for the National Endowments for the Arts and the Humanities. “I’m proud to introduce this bill alongside Congresswoman Bonamici to help put the ‘A’ back in STE(A)M, and move full steam ahead on supporting arts programming and education access for all.”

“Art teachers across my district shared stories of the power that arts education has on our youngest children. It opens up a love for learning and allows them to thrive in new and exciting ways. The arts also help us celebrate our cultures, our identities, and communities,” said Congresswoman Teresa Leger Fernández. “I’m proud to join Rep. Bonamici on the Arts Education for All Act to give educators the support they need to expand arts programming experiences for children of all ages. It will ensure they can foster a learning environment that promotes creativity, expression, and healing through art.”

The Arts Education for All Act has been endorsed by more than 100 national, state, and local organizations, including the Pennsylvania Music Educators Association, Americans for the Arts, National Association of Music Merchants, and Grantmakers in the Arts.

The full list of endorsements can be found here.

“From her direct engagement throughout the arts sector, to successfully including pro-arts amendments in the Every Student Succeeds Act, Rep. Bonamici has once again proven herself to be a champion for arts education,” said Nolen V. Bivens, President and CEO, Americans for the Arts. “Americans for the Arts considers the “Arts Education for All Act” to be the most comprehensive arts education bill ever introduced in Congress and is proud to endorse it. We will work to advance this legislation alongside arts education stakeholders in music, dance, theater, visual, and media arts in order to pursue increased access and equity for all learners.”

“The Arts Education for All Act will help bring the power of arts education to early childhood programs, low-income K12 students and systems-involved youth on a scale we haven’t seen before,” said Eddie Torres, President and CEO of Grantmakers in the Arts. “By empowering childcare, K12 schools, and programs serving systems-involved youth, this bill has the potential to enrich lives and expand educational opportunities for millions,” said Eddie Torres, President and CEO of Grantmakers in the Arts. “The arts community, but most importantly the children of our nation, owe a great deal of thanks to the innovative leadership of Representative Bonamici for introducing this critical legislation.”

A one-page summary of the Arts Education for All Act can be found here. The text of the legislation can be found here.

The legislation is co-sponsored by Representatives Bishop (D-GA), Bowman (D-NY), Cárdenas (D-NY), Cicilline (D-RI), Cohen (D-TN), Cooper (D-TN), Jayapal (D-WA), Jackson Lee (D-TX), Carolyn Maloney (D-NY), McGovern (D-MA), Norton (D-DC), Raskin (D-MD), Ross (D-NC), and Titus (D-NV).

Pennsylvania Masking Order

|

|

|

|

Back To School Resources from PMEA

|

|

|

|

|

|

Pennsylvania 2021-22 State Budget

Governor Tom Wolf signed the Pennsylvania 2021-22 state budget and other laws this week. Here is a breakdown of impacts to education.

State Budget

The $40.8 billion budget is a spending increase of $1 billion, or 2.6% from last year’s budget when supplemental spending and federal stimulus spending is included.

The budget utilizes about $1 billion of the $7.3 billion the state received in federal American Rescue Plan (ARP) funds, with the General Assembly opting to hold the balance of that money which is allowable and can be used over the next three years. In addition the state had nearly $3 billion in surplus revenue to work with.

The state made a $2.52 billion deposit into the state’s Rainy Day Fund, bringing the balance to a historic $2.76 billion. The record-high boost to that fund was made possible because of surplus revenue plus the previously noted $7.3 billion in federal COVID-19 relief dollars.

Included in the budget are:

- $200 million increase for basic education, the main stream of state dollars for school districts. The money will be distributed through the state’s fair funding formula passed into law in 2016.

- $100 million for Level Up, a new initiative providing additional funding to the 100 most underfunded districts in the state. This additional $100 million was a compromise measure as Governor Wolf unsuccessfully pushed for a substantially larger amount of money for education this year in an effort to have all money going to K-12 education funnel through the fair funding formula.

- $50 million increase for special education.

- $30 million increase for early education, which includes $25 million to expand Pre-K Counts and $5 million to expand Head Start.

- The Pennsylvania State Higher Education System, was level funded at $ 477.5 million. However, the system received $50 million from the federal ARP funds to be dedicated to the system re-design. That re-design has not been approved and has been controversial. PMEA continues to monitor the re-design process and how it may impact music education programs at state system schools.

- The proposed Nellie Bly scholarship that was designed to provide scholarships for students attending Pennsylvania State System of Higher Education schools is not included in the budget.

- The budget includes a $225 million allocation — a $40 million increase — toward the state Educational Improvement Tax Credit program, which gives tax credits to businesses that fund scholarships for private schools.

This spreadsheet from the Pennsylvania Department of Education spells out district funds coming from the state to districts as well as level up amounts.

Any increase in the basic education subsidy is a win as Pennsylvania continues to fall behind other states in the percentage of state support for public education.

Other Notable Legislation

Renewal of Substitute Teacher Provision for Prospective Educators

Intermediate units and area career and technical schools may utilize individuals training to be teachers to serve as a substitute teacher, provided the individual has valid clearances and at least 60 credit hours.

Optional year of instruction due to COVID-19

This bill provides extended special education enrollment as well as an optional year of education for students due to the pandemic. Parents must elect to enroll the student by July 15, 2021. The PA Department of Education will create a standard election form for parents to use.

Under the bill, a special education student who has reached age 21 during the 2020-21 school year or before the start of the 2021-22 school year may continue to be enrolled for the upcoming year.

The bill also permits any student under the age of 18 to repeat a grade level of instruction for the 2021-22 school year at the parent’s request; a child at or over the age of 18 may also make a request. The student may continue to participate in academic or extracurricular activities, including interscholastic athletics.

PMEA Sends Letter to PA Superintendents About Federal Funding

In our on-going push to raise awareness of how federal Elementary and Secondary School Emergency Relief (ESSER) stimulus funds can be used for music and arts education, PMEA sent a letter to every school district superintendent in Pennsylvania reminding them of the ESSER funds and asking them to reach out to the federal program coordinator in their school district to remind them about how these funds can be used for music and arts education.

You can download a copy of the letter here and we encourage you to send a copy to your superintendent as reinforcement of the message of the value of these funds.

Learn more about how you can request these funds for you music program here.

Congratulations to the Best Communities for Music Education Pennsylvania Designees!

Congratulations to the 686 school districts that are among the Best Communities in the nation for music education and the 80 schools that received the SupportMusic Merit Award (SMMA) from The NAMM Foundation! The award program recognizes outstanding efforts by teachers, administrators, parents, students and community leaders who have made music education part of a well-rounded education. Designations are made to districts and schools that demonstrate an exceptionally high commitment and access to music education.

Learn more at www.nammfoundation.org

Here are the Pennsylvania Best Communities and SupportMusic Merit Award designees. Congratulations!

| East Hills Middle School | Bethlehem | PA | 18017-2761 |

| Lancaster Catholic High School | Lancaster | PA | 17601-4360 |

| Propel Schools – East | Turtle Creek | PA | 15145-1652 |

| Somerset Area Junior and Senior High Schools | Somerset | PA | 15501-2565 |

| St. Francis School | Clearfield | PA | 16830-2206 |

PMEA Policy Playbook

In anticipation of a year that will require advocacy for music and arts education like we’ve never seen before, PMEA has issued the 2021 PMEA Policy Playbook. This guide is designed highlight the issues PMEA will advocate for in 2021.

Of course, we realize the changing environment will require advocacy and information efforts in other areas as well and we will react to those accordingly.

Governor Wolf Unveils Proposed 2021-22 State Budget

Governor Tom Wolf announced his 2021-22 budget proposal yesterday. The plan calls for $1.5 billion more dollars for education. Most of his proposed increase in funding would flow through the fair funding formula enacted five years ago. $1.35 billion of his proposal would be distributed as part of the basic education subsidy, which allows schools to use the money for primary operations.

The proposal would bring the total distributed through the basic education subsidy to $8.1 billion. This would provide a significant increase to schools. However, it’s important to remember this is only Wolf’s proposal.

To pay for this large increase in education funding as well as other proposed initiatives, Wolf is proposing an increase in the personal income tax. That increase would not impact all taxpayers based on the proposal. Some tax payers would end up paying less taxes while the highest earners would pay more. Wolf is also calling for other income generators in the budget, however the personal income tax increase would bring in the most money.

Opposition to the budget has already begun. Tax increases are unpopular – even if a portion of the population won’t actually pay more taxes. And, there is a provision in the Pennsylvania Constitution that does not allow unequal tax rates. Budget hearings will begin soon to discuss Wolf’s most ambitious proposal yet.

Federal Funds Available for Schools

In December 2020, as part of COVID-19 financial relief, Congress allocated more funds schools can use to address issues related to the pandemic – specifically learning loss. The Elementary and Secondary School Emergency Relief Fund Round II (ESSER II) can be used for a wide variety of activities.

You can find your school district or charter school’s preliminary allocation on PDE’s website.

We suggest you begin conversations now with your administrators on ways to use some of the ESSER II funds for your music programs. You may also want to inquire about the allocation of the first round of ESSER funds in case there is unallocated funds in your district or charter school.

Here is a list of possible ways you can use the ESSER finds. Keep in mind the goal of these funds is to address learning loss during the pandemic.

- Paying for remediation in music education – in school or after school programming

- A learning “camp” to address learning loss

- Purchase of software that assists with in person, hybrid, or remote learning and assessment

- Facility repairs and improvements including proper ventilation

- Instrument sanitizing supplies

- PPE for music classes – masks, bell covers, etc

- Purchase or rental of instruments for students that are financially unable to obtain them

- Purchase or rental of instruments that were typically shared by students but more are needed to avoid sharing

- Professional development for music educators related to in-person learning in a safe way

Materials needed to set up a classroom with a physical distance between students (sheet music, music stands, media cart, etc.)

Download a PDF copy of the 2021 PMEA Policy Playbook

Download a PDF copy of the 2021 PMEA Policy Playbook